Pay your rates

About

You can pay your rates online, in person, or in instalments. Rates are calculated for the financial year. Your 4 instalments are due on the same dates each year:

- 30 September (extended until 15 October 2025)

- 30 November

- 28 February

- 31 May

Pay your rates

You pay your rates in 4 instalments (as per s167(1) & (2) of the Local Government Act 1989). If your instalments are paid late, you may be charged interest.

If you want to pay all 4 instalments at once, you must do so by the due date of the first instalment (30 September). We do not allow any other lump sum payments of rates.

Check your rates notice for instalment amounts. We send you a reminder notice before each instalment is due.

If you are struggling to pay your rates on time you can request a rates payment plan or apply for financial hardship

Check how much you need to pay

If you are a property owner and cannot find your rates notice, you can contact us on 1300 787 624 to find out the rates amount due.

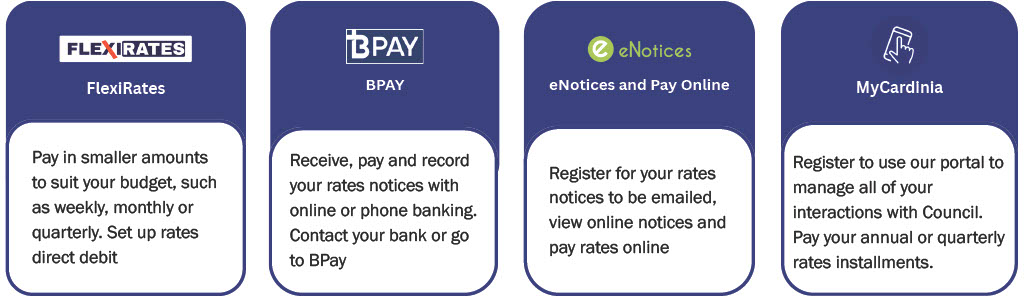

Ways to pay your rates

You can pay your rates using

- Direct debit (FlexiRates)

- BPAY

- eNotices and pay online

- MyCardinia

Other ways to pay

- Regular deductions from your Centrelink payment via Centrepay (CRN: 555 012 959V)

- Use Post Billpay

- Pay your rates in person at our civic centre, 20 Siding Avenue, Officer.

If you have overpaid or made a payment mistake, you can request for a rates refund

Apply for help to pay rates

If you’re facing financial hardship or worried about paying your rates, we can help. Call us on 1300 787 624 or see options on rates payment plans and applying for financial hardship